Once a new card has been requested, it typically takes 7-10 business days to arrive.

-

Simple & fast balance transfers

Save on interest when you transfer higher-interest credit card balances to an SECU Visa Credit Card.2

-

Card Lock

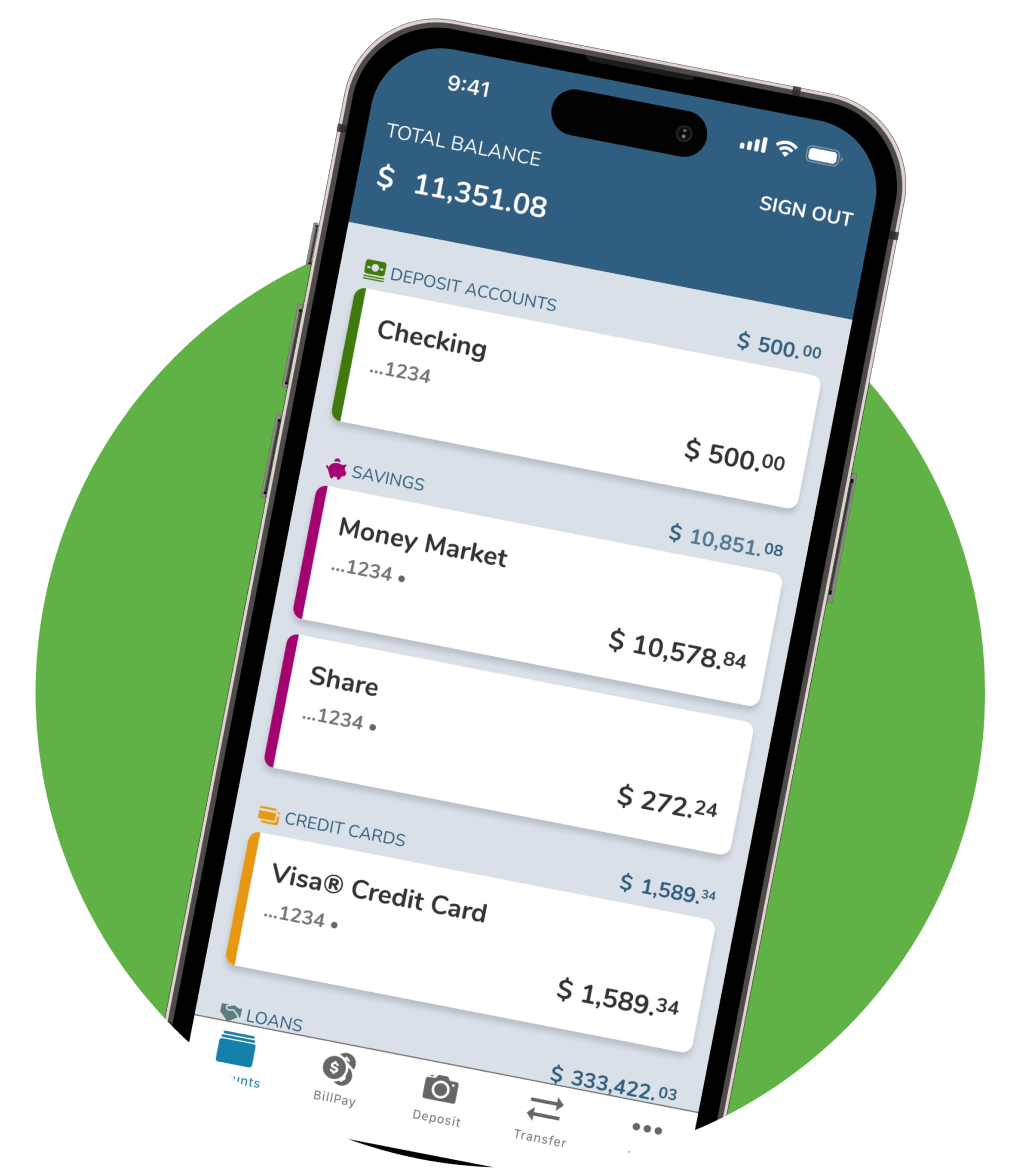

Protect your account from unwanted transactions by locking your credit card directly from the Mobile App.

-

Tap-to-pay

Enjoy contactless payment for fast, easy, and secure checkout.

-

Mobile wallet compatible

Add cards to your mobile wallet to simplify and secure your shopping with Mobile Payments.

-

Visa Zero Liability

You are protected from unauthorized or fraudulent charges on your card.3

Card benefits

Enjoy these benefits with your SECU Credit Card.

Frequently asked questions about the Visa Credit Card

Members may apply for an SECU Credit Card online through Member Access, over the phone by contacting Member Services Support at (888) 732-8562, or at your local branch. Members must be 18 years of age or older or otherwise eligible for lending services to apply. New lending is restricted to residents of North Carolina, South Carolina, Georgia, Tennessee, and Virginia.

To report a lost or stolen card, contact Member Services Support at (888) 732-8562 or your local branch. Our representatives can assist you with replacing your card and reporting any fraudulent transactions. If you think you’ve misplaced your card and would like to look for it before requesting a replacement, use the Card Lock feature in the Mobile App while you search.

You can pay off your high interest loans and credit card balances from other institutions by transferring your balance to your SECU Visa Credit Card. Learn more about Credit Card Balance Transfers.

You can request a credit line increase through Member Access, by contacting Member Services Support at (888) 732-8562, or at your local branch. Credit line increases are permitted for existing credit cards regardless of the state in which you reside. Credit line increases must be approved and are not guaranteed.

Your credit limit may automatically increase from time to time based on your repayment history and other factors. We will notify you of any automated increase. Contact us if you’d like to decline automated increases.

Visa applies a fee to any international transaction. The fee is 1% of the U.S. dollar amount of the international transaction. An international transaction includes (a) any transaction made in a foreign country, and (b) any transaction made or processed outside of the United States. For more information regarding international credit card transactions, see the Credit Cardholder Agreement on our Account Disclosures page.

You can dispute credit card transactions through Member Access, by contacting Member Services Support at (888) 732-8562, or at your local branch.

If you notice transactions that you did not make or approve, notify us immediately by contacting Member Services Support at (888) 732-8562. If you do not report fraud in a timely manner, we may not be able to reimburse you.

You can make payments online through Member Access by transferring money from another SECU account, over the phone by contacting Member Services Support at (888) 732-8562, at a CashPoints® ATM, or at your local branch.