Tax Refund Information

If you are expecting a tax refund this year, the fastest way to receive your refund is to have the IRS send the money to your account via Direct Deposit.It is very critical that you provide the IRS with correct information as demonstrated below:

Routing Number

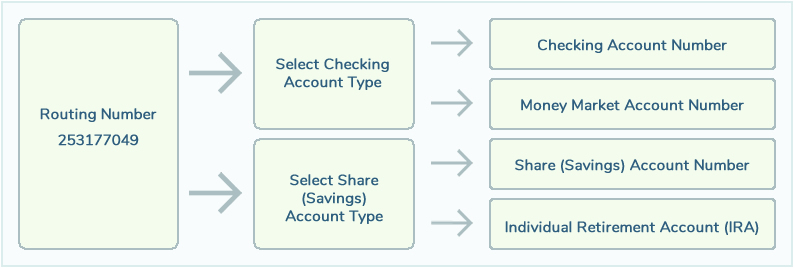

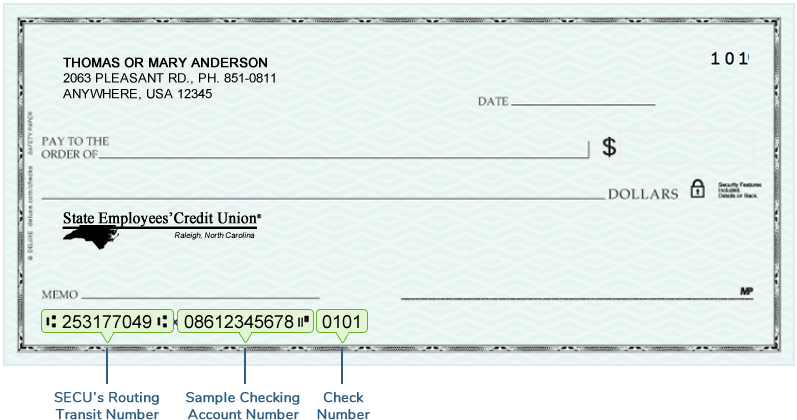

You will need to provide the routing number for your Direct Deposit. SECU's nine digit routing number is 253177049.Account Type & Account Number

You can select to have your money deposited into your checking, money market, share or IRA account. When completing your tax return for a refund, it is important that the account type and account number you provide are correct.

Note: Your account number can be obtained from your monthly statement or Member Access. Your checking account number is also printed at the bottom of your personal checks.

What happens when my return is filed with incorrect account information?

- When filing your return, errors in the account number, account type, or routing number can result in your refund being deposited into someone else's account. It can be difficult or impossible for the IRS or Department of Revenue to retrieve those funds as they will have processed the transaction as you instructed.

- Whether completing your return yourself or using a tax preparer, you should always personally verify the accuracy of your deposit account information. Direct Deposits that are rejected due to incorrect information are reissued by the IRS and Department of Revenue as paper checks if the IRS or Department of Revenue is able to retrieve the funds. Reissuances can take up to 8 weeks to be processed. Paper checks will be mailed to the address listed on the tax return. If they are unable to retrieve the funds, you will not receive your refund.

- Always double check the routing number, account type and account number before filing your return or allowing a tax preparer to file it.

- Never authorize the deposit of your tax refund into an account on which you are not listed as an owner. You cannot be given access to funds in an account that is not in your name, which can lead to delays and/or loss of funds if the owner of the account will not reimburse you or the funds are no longer available.